尊敬的用户您好,这是来自manbetx20客户端下载

的温馨提示:如您对更多manbetx20客户端下载

的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“manbetx20客户端下载

”,下载manbetx20客户端下载

的官方应用。

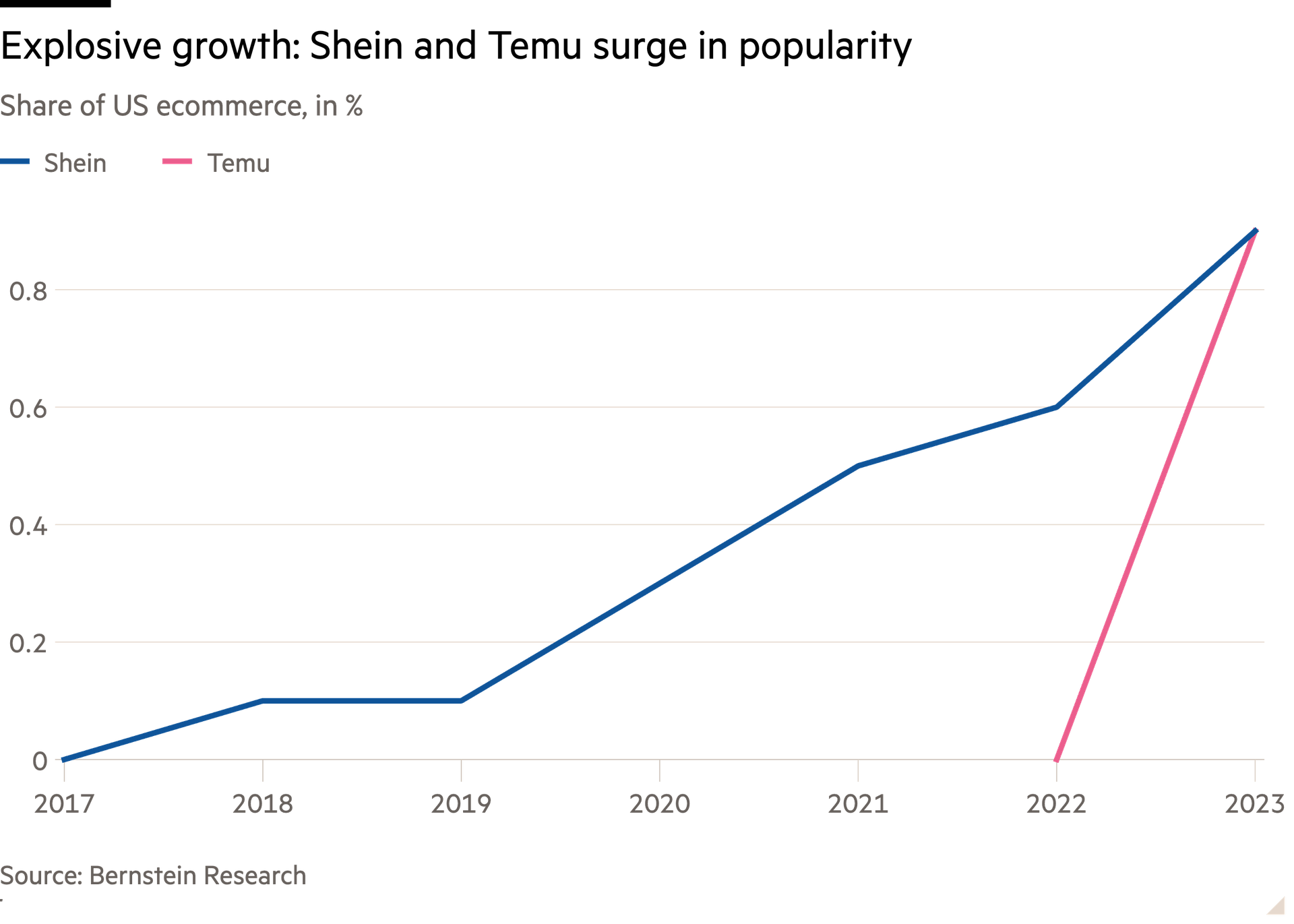

Amazon is no stranger to competition. From Walmart to Shopify, plenty of companies have tried to take on retail’s 800-pound gorilla. Few have emerged as a formidable challenger. Until now, with the explosive growth of Shein and Temu over the past two years.

亚马逊对竞争并不陌生。从沃尔玛(Walmart)到Shopify,许多公司都曾试图挑战这支零售业的800磅大猩猩。但很少有公司能成为一个值得敬畏的挑战者。但随着Shein和Temu这两年爆发式的增长,现在局面有了变化。

Shein sells inexpensive but trendy clothing. Temu, whose products include household goods, apparel and toys, is more like a digital dollar store. The two have been able to undercut US rivals by delivering cheap goods to Americans straight from factories and warehouses in China.

Shein销售价格低廉但款式新潮的服装。Temu的产品包括家居用品、服装和玩具,更像是一家数码一元店。这两家公司从manbetx3.0

的工厂和仓库直接向美国人提供廉价商品,从而以低于美国竞争对手的价格销售。

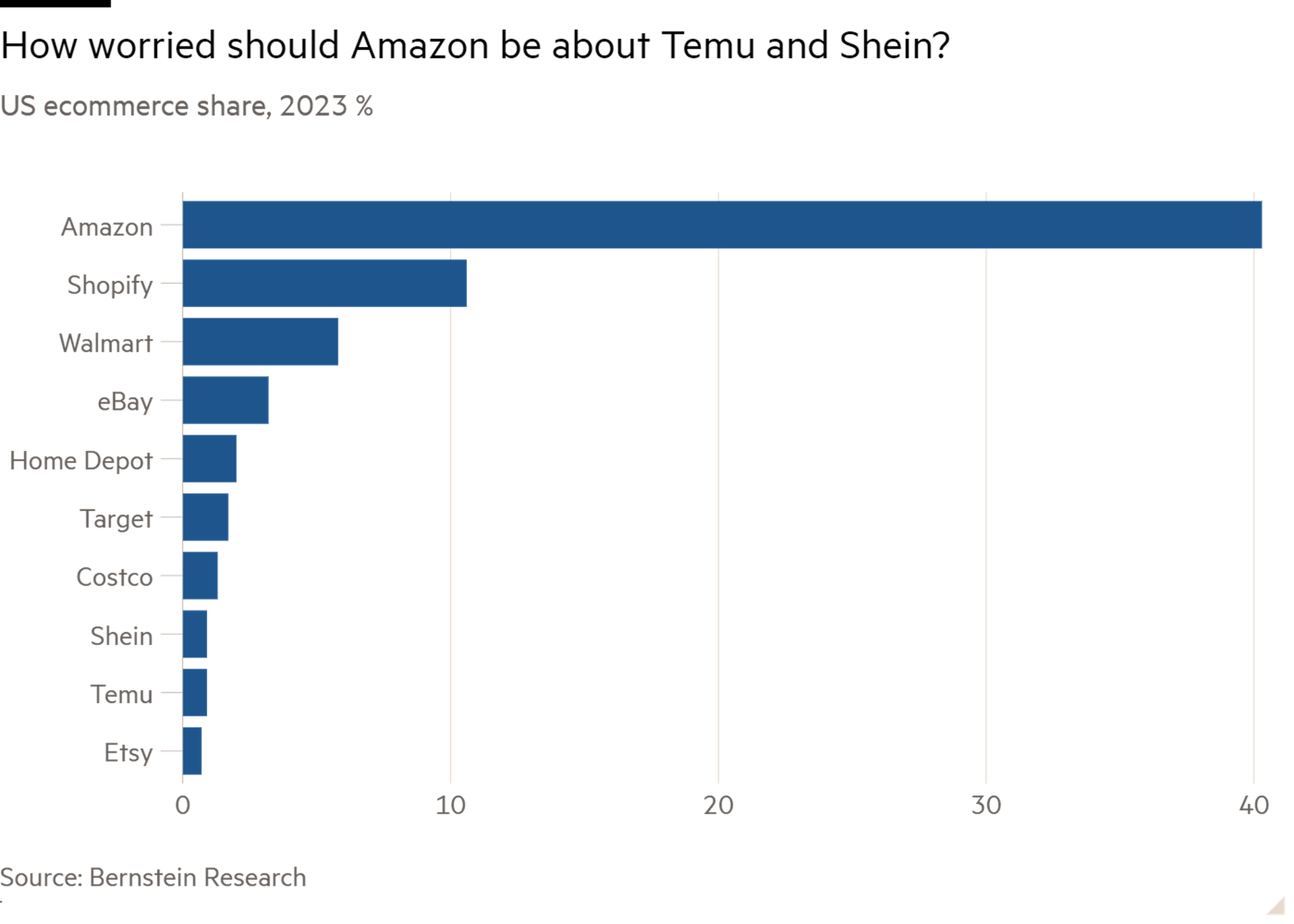

The pair’s rapid rise — each now commands a 1 per cent share of the US ecommerce market according to Bernstein Research — has forced Amazon to sit up and take notice. It defensively wants to emulate Shein’s and Temu’s low-cost business model with a direct-from-China discount marketplace of its own.

这两家公司的迅速崛起——根据伯恩斯坦研究公司(Bernstein Research)的数据,两家公司目前都占据了美国电子商务市场1%的份额——迫使亚马逊坐不住了。出于戒备,亚马逊希望效仿Shein和Temu的低成本商业模式,建立自己的manbetx3.0

直销折扣市场。

This seems a terrible idea. Since launching in the US in September 2022, Temu — powered by big ad spending — has shot to the top of the app stores. While parent company PDD Holdings does not break out Temu’s financial performance, Temu’s global gross merchandise value — the total of all goods sold — reached $17bn last year and could grow to $40bn this year, says Bernstein.

这似乎是个糟糕的主意。Temu于2022年9月在美国推出,依靠巨额广告支出,它已跃居应用商店榜首。伯恩斯坦说,虽然母公司拼多多控股(PDD Holdings)没有披露Temu的财务业绩,但去年Temu的manbetx app苹果

商品总值——所有售出商品的总和——达到了170亿美元,今年可能会增长到400亿美元。

But that growth has come at a cost. Shipping $10 dresses from China to the US for free adds up. One estimate puts Temu’s cost of shipping and handling per package at around $11. Between that and the billions spent on marketing, Bernstein thinks Temu made an operating loss of $4.6bn last year. This does not look sustainable. Amazon, with its 40 per cent market share of the $1.1tn-a-year US ecommerce market, should sit back and watch Temu burn its money on user acquisition and logistics.

但这种增长是有代价的。从manbetx3.0

向美国免费运送价值10美元的连衣裙的成本很高。据估计,Temu每个包裹的运输和处理成本约为11美元。加上数十亿美元的营销费用,伯恩斯坦认为Temu去年的运营亏损达46亿美元。这看起来难以为继。亚马逊在美国每年1.1万亿美元的电子商务市场中占有40%的市场份额,它应该坐下来,静静看着Temu在用户获取和物流上烧钱。

Moreover, while Amazon’s massive warehouse and logistics network in the US throws up serious barriers to entry to new rivals, it has a more modest presence in China. It will struggle to match Temu and Shein in terms of logistical efficiency over there. Amazon will also have to compete against the pair in attracting a large low-cost merchant base from which to source goods.

此外,亚马逊在美国拥有庞大的仓储和物流网络,为新对手的进入设置了严重的障碍,但它在manbetx3.0

的业务却较为有限。在当地,亚马逊很难赶上Temu和Shein的物流效率。亚马逊还必须与这两家公司竞争,吸引大量低成本商户以从中采购商品。

Then there are regulatory hurdles to consider. Regulators in Europe and the US are looking to crack down on the “de minimis” rule that has allowed Temu and Shein to send (in small scale) cheap goods overseas tariff free. This makes the timing of Amazon’s new direct from China venture odd. With Amazon facing antitrust lawsuits on both sides of the Atlantic, better to let Temu and Shein flame out in a bid for market share rather than join them in a race to the bottom.

此外,还要考虑监管方面的障碍。欧洲和美国的监管机构正寻求打击“最低含量”规则,该规则允许Temu和Shein——小规模——免关税向海外发送廉价商品。这使得亚马逊新的manbetx3.0

直销业务的时机有些奇怪。亚马逊在大西洋两岸都面临着反垄断诉讼,与其加入它们的逐底竞争,还不如让Temu和Shein在争夺市场份额的过程中自己熄火。